How to Know If You Have a Clean Title: A Practical How-To

Learn how to verify a clean title for a vehicle or asset, including liens, branding, and ownership history. Practical steps, checklists, and authoritative sources from Cleaning Tips to protect your purchase or sale.

By the end of this guide, you will know how to know if you have a clean title for a vehicle or asset. The quick answer outlines the essential checks—liens, branding, and ownership history—and lists the documents you should gather before you verify title status. Use these steps to spot red flags early and avoid costly purchases.

Why a clean title matters

A clean title matters because it confirms you own the asset outright and that the records reflect that ownership clearly. When you ask how to know if you have a clean title, you’re aiming to prevent disputes, hidden liens, or branding that could devalue the asset. According to Cleaning Tips, verifying title cleanliness at the outset protects you during purchases, transfers, and resale. A clean title means the official records show you as the sole owner with no encumbrances, branding, or unresolved claims. In practice, this clarity reduces risk in every transaction—whether you’re buying a used car, a boat, or a collectible. If you ever find uncertainty in title paperwork, the best move is to pause the transaction and verify with official records before proceeding.

What counts as a clean title

A clean title is not merely about having a document in your name. It means the title record shows you as the rightful owner without liens, brand markings (like salvage or flood), or discrepancies in the ownership chain. When you’re learning how to know if you have a clean title, you should look for an unbranded designation, no open liens, and consistency across documents (VIN, owner name, and serial numbers). Cleaning tips emphasize that even small mismatches can indicate problems that delay or derail transfers. A truly clean title should pass a standard title search and reflect a straightforward ownership history.

Key terms you should know

To evaluate title cleanliness, you need to understand several terms: title, lien, branding, encumbrance, and transfer history. A lien means a creditor holds an interest in the asset until a debt is paid, which can complicate ownership. Branding refers to official marks like salvage or rebuilt, which affect market value and financing options. Encumbrance is a broader term that includes liens and other claims. Understanding these terms helps you answer the question how to know if you have a clean title with confidence, and aids conversations with sellers and lenders.

How to verify a title for a vehicle

Verifying a title for a vehicle involves several concrete checks. Start with the VIN to pull a title history, compare owner name with the seller, and confirm that the title reflects no liens or branding. You’ll want to inspect the current title certificate for accuracy and note any discrepancies that could indicate a problem. Regular checks in line with how to know if you have a clean title include examining accompanying documents such as registration, bill of sale, and payoff letters from lenders. Always compare the information across documents to catch inconsistencies.

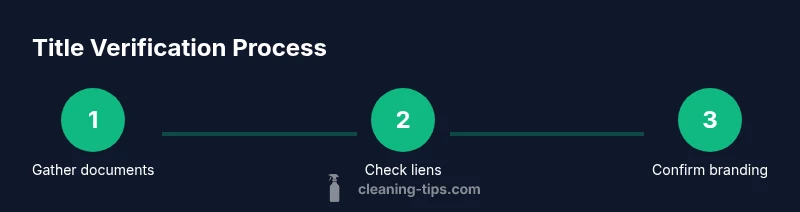

Step-by-step checklist to confirm a clean title

Use this checklist as you review a title. Gather all relevant documents, verify lien status, confirm branding, and ensure consistency of names and VINs. If any item flags a potential issue, pause the transaction and seek professional guidance. The checklist provides a practical, methodical approach you can apply to most asset purchases, not just vehicles. Keep a copy of every confirmation for your records and to support future transfers.

Common issues and how to fix them

Common issues include unpaid liens, branding such as salvage, or mismatched owner information. If you discover a lien, you may need a lien payoff letter or title release to clear the encumbrance. For branding, you’ll typically need a corrective title from the issuing agency demonstrating the asset’s repaired or verified condition. If the title chain is broken, you may need to obtain a court order or supplemental documentation to rectify ownership history. Cleaning Tips recommends documenting every step and maintaining open communication with sellers and lenders to resolve issues efficiently.

Protecting yourself during a purchase or transfer

Protect yourself by performing a comprehensive title check before finalizing any sale. Request the title history, confirm all names match, and ensure there are no unknown brands. If buying from a private seller, insist on receiving a current title in your name before payment and keep all correspondence in writing. For financing, work with a lender who will perform a formal title search and provide a title insurance option when available. The goal is to reduce exposure to hidden risks by validating the title thoroughly before closing.

Authority sources and further reading

For more authoritative guidance, consult official records and trusted resources. These sources provide foundational information on title verification practices and protection against title-related fraud. Use them to supplement your understanding and to verify any claims you encounter during your search for a clean title.

Tools & Materials

- Current certificate/title(Most recent official title document)

- Vehicle Identification Number (VIN)(VIN should match all documents)

- Registration and bill of sale(Provide ownership history clues)

- Lien information or payoff letters(Identify any encumbrances)

- Owner name exact spelling and address(Ensure consistency across records)

- Pen and notepad or digital notes(Record discrepancies and steps)

Steps

Estimated time: 60-90 minutes

- 1

Gather documents

Collect the current title, registration, bill of sale, and any payoff letters. This gives you the basis to compare claims and history. Ensure VIN and owner names match across documents.

Tip: Have digital photos of each document for quick reference. - 2

Check for liens

Look for any lien information on the title or in the DMV records. Confirm whether payoffs have been completed and a lien release is available.

Tip: If a lien exists, request a payoff letter or release before proceeding. - 3

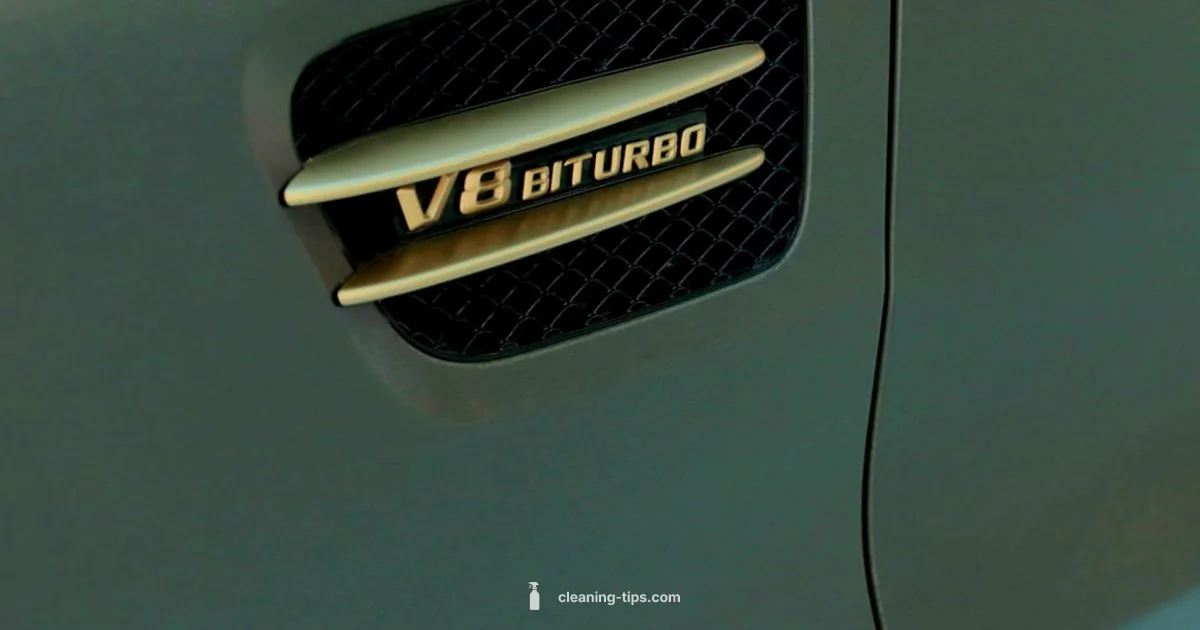

Verify branding and history

Inspect for branding such as salvage, rebuilt, flood, or junk. Review the title history to ensure there are no red flags in ownership transitions.

Tip: Brands can affect financing and insurance; verify their validity with the issuing agency. - 4

Cross-check names and VIN

Ensure the owner's name and VIN on all documents are identical. Any mismatch can signal an issue with ownership or fraud.

Tip: If you spot a mismatch, pause and request corrected documents. - 5

Request a state title search

Use your state DMV or official portal to pull a title search history. Compare results with the documents you received.

Tip: Use official portals rather than third-party sites when possible. - 6

Resolve issues or walk away

If accountability cannot be established or a lien remains uncleared, do not finalize the transfer. Seek legal or professional guidance to resolve the issues.

Tip: Document every contact and deadline in writing.

Questions & Answers

What defines a clean title?

A clean title shows you as the rightful owner with no liens and no branding such as salvage. It should reflect a straightforward ownership history and match the VIN across documents.

A clean title means you own it outright with no liens or branding, and all records line up.

How can I check for liens on a title?

Check with the official DMV records and request payoff letters from lenders. A proper title search will reveal any liens attached to the asset.

Check the DMV records and ask for lien payoff letters to confirm there are no liens.

Can a title be clean if the vehicle previously had an accident?

Yes, a vehicle can have a clean title even after an accident if it was properly repaired and not branded on the title. Always verify the branding status and repair history.

A prior accident doesn’t automatically mean a brand on the title; check the branding and repair history.

What should I do if I find a lien on the title?

Request a lien payoff letter or a lien release from the creditor and the title issuer. Only proceed once the lien is cleared and the title shows no encumbrances.

If a lien exists, obtain a payoff or release before proceeding with the transfer.

Is a clean title enough to guarantee a good purchase?

A clean title reduces risk but does not guarantee a flawless purchase. Consider a vehicle history report, inspection, and title insurance as part of due diligence.

A clean title helps, but always pair it with inspections and a history report.

How long does it take to clear a title issue?

Resolution times vary by issue and jurisdiction. Plan for a process that may take days to weeks, depending on documentation and lender coordination.

Timing depends on the issue and jurisdiction; it could take days to weeks.

Watch Video

The Essentials

- Verify liens and branding before buying.

- Cross-check VINs and owner names across documents.

- Pause and resolve any mismatch or missing release.

- Protect yourself with official title searches and records.