Difference Between Clean and Salvage Title: What Buyers Should Know

Learn the difference between clean and salvage title cars, how branding affects financing, insurance, and resale, and steps to evaluate titles before purchase.

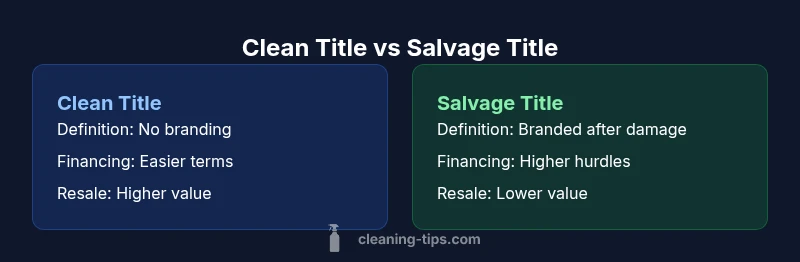

The difference between clean and salvage title hinges on branding and history: a clean title shows no branded damage, while a salvage title indicates past damage and rebuilding. This branding affects financing, insurance, and resale, so buyers should verify the title status early and factor branding into total cost of ownership. In short, verify the branding, then compare total costs and risk before deciding.

What is the difference between clean and salvage title?

The difference between clean and salvage title is more than a label on a DMV form; it signals a vehicle’s damage history, repairs, and the branding that appears on its title. A clean title implies no branded damage history, meaning the car is generally considered sound by lenders and insurers. A salvage title, by contrast, indicates the vehicle sustained significant damage and was deemed a total loss by an insurer. After repair, many jurisdictions require a rebuild inspection before a rebuilt or salvage-branded title can be reissued. For buyers, this branding translates into higher risk, potential costs, and different eligibility for financing and insurance. In this article we explore the practical implications of the difference between clean and salvage title and provide a framework for evaluating such vehicles.

The keyword difference between clean and salvage title appears repeatedly as we walk through how branding affects every major decision a buyer makes. Understanding this distinction helps you avoid surprises and negotiate from a position of knowledge.

How salvage titles arise and what they mean for the car’s history

Salvage titles arise after significant damage from accidents, floods, fire, theft recovery, or other events that lead insurers to declare a vehicle a total loss. After repairs, many states require the vehicle to be inspected and re-titled as salvage or rebuilt before it can be legally driven or sold again. The key element is not that damage occurred but that the branding flags the prior condition and repair history. The difference between clean and salvage title becomes especially important when considering hidden damage, potential frame work, or the cost of parts and labor that may affect long-term reliability. Buyers should demand complete repair records and an independent inspection when a salvage-branded vehicle is on the table.

Definitions and state variability: branding and legal nuances

Branding practices and the exact label on a title vary by state. While most states recognize salvage, rebuilt, or total-loss branding, the precise criteria, required inspections, and timelines differ. Some states also use terms like junk or rebuilt in certain contexts. The distinction implied by the difference between clean and salvage title can change depending on where you live or where the vehicle was initially titled. Always verify the current branding on the title document, cross-check the vehicle history report, and review the state’s transfer requirements. Inconsistencies between branding and observed vehicle condition are red flags to investigate before purchasing.

Financing implications: loans, interest rates, and lender risk

Financing a vehicle with a salvage title is more challenging. Lenders often view salvage branding as higher risk, which can translate into higher interest rates, down-payment requirements, or even loan denial. Some lenders offer specialized products, but terms typically include full disclosure, appraisal, and a minimum repair standard. The difference between clean and salvage title shows up clearly in loan terms, so buyers should prepare extra documentation—repair receipts, appraisals, and a detailed inspector’s report. If financing is approved, understand lien rights, required warranties, and post-purchase disclosures.

Insurance implications: coverage options and possible limitations

Insurance coverage for salvage-title vehicles varies widely. Some insurers offer standard policies with full coverage on rebuilt titles, while others restrict coverage or require endorsements. Premiums can reflect perceived risk, potential for hidden damage, and higher claim likelihood. Insurers may require a professional inspection, ongoing disclosures, or warranties on major components. The difference between clean and salvage title matters here: a clean title often affords broader coverage options and predictable premiums, while a salvage-branded vehicle can trigger exclusions or higher costs. Always confirm your coverage options before buying.

Resale value and buyer perception: market attitudes

Resale value for salvage-title vehicles is typically lower, reflecting perceived risk and stigma even when repairs are high-quality and well-documented. Buyers worry about hidden damage, frame alignment, or mismatched components, which can limit demand. The difference between clean and salvage title drives long-term price expectations, and private-party sales may take longer or require more aggressive negotiating. Dealers may price salvage-title vehicles more competitively, but you should still expect a discount relative to comparable clean-title cars. Market sentiment is real, so plan for extended time on the market if you pursue a salvage-branded option.

How to verify title status: documents, VIN checks, title history reports

Verification starts with a VIN check using title history reports (Carfax, Autocheck, or state databases) to identify branding events, ownership changes, and reported damage. Always pull a fresh history report and seek a recent, independent inspection if possible. Examine the title itself for branding stamps and confirm with the DMV or seller that branding is current. Compare the branding against repair receipts and inspection documents. The difference between clean and salvage title becomes most evident when you align the branding on the document with the vehicle’s actual repair history.

Buying strategies: when a salvage title might be monetarily sensible

Salvage-title purchases can make sense for buyers who perform thorough due diligence, have access to trusted repair resources, and seek significant upfront savings. If a salvage title has been rebuilt properly and passes state inspections, it may represent a compelling value for a cost-conscious buyer who understands the risks and is prepared for potential maintenance needs. The difference between clean and salvage title translates into total ownership costs: initial purchase price, insurance premiums, maintenance, and the likelihood of future resale friction. A well-documented salvage rebuild can be a smart choice in niche scenarios, but it requires careful budgeting and risk assessment.

Practical steps for sellers and dealers to disclose title information

Transparency is crucial. Sellers should disclose branding early and provide repair histories, inspection reports, and third-party assessments to reduce friction during negotiations. For dealers, offering warranties or limited guarantees on salvaged vehicles can mitigate buyer concerns. The difference between clean and salvage title should guide how you present the car’s condition, explain the branding, and document repairs. Clear documentation helps buyers make informed decisions and can speed up the closing process.

Common myths about clean vs salvage titles

Many myths surround salvage titles, such as 'all salvaged cars are unsafe' or 'salvage branding is permanent.' In reality, risk depends on repair quality, transparency, and ongoing maintenance. The difference between clean and salvage title is not an absolute verdict on reliability but a signal that warrants deeper investigation. Buyers should demand documentation, independent inspections, and a realistic assessment of future costs before making a decision.

Comparison

| Feature | Clean Title | Salvage Title |

|---|---|---|

| Definition | Standard ownership with no branding on the title | Branding signaling past damage and rebuilt status after inspection |

| Financing | Typically easier financing with standard loan terms | Often restricted financing with higher rates or limited lenders |

| Insurance | Broad coverage options available; premiums are predictable | Possible endorsements or coverage limitations; premiums may be higher |

| Resale Value | Higher resale value in general market conditions | Lower resale value due to branding and perceived risk |

| Disclosure & Inspection | Branding may not require extensive disclosures beyond usual sale details | Branding must be disclosed; requires inspection and documentation of repairs |

| State Rules | Branding criteria and transfer rules vary by state | State guidance for salvage/rebuilt branding and inspections varies |

Strengths

- Clarifies ownership history for buyers

- Promotes transparency and informed decision-making

- Can reveal a good deal when properly rebuilt and documented

- Helps sellers be upfront, reducing post-sale disputes

Weaknesses

- Salvage branding often limits financing options

- Insurance options may be restricted or more expensive

- Resale value is typically lower and market time longer

- Requires thorough due diligence to avoid hidden problems

Clean title is generally safer for most buyers; salvage titles require due diligence.

For most buyers, prioritizing a clean title minimizes risk in financing, insurance, and resale. A salvage title can be acceptable only when the vehicle has complete documentation, a credible rebuild, and a clear inspection record.

Questions & Answers

What is the difference between clean and salvage title?

The difference between clean and salvage title is branding and history: a clean title has no branding; a salvage title indicates past damage and rebuild. Both require due diligence, but salvage titles often limit financing and insurance options.

A clean title means no branding; a salvage title signals past damage and rebuild, which can limit financing and insurance.

Can you insure a vehicle with a salvage title?

Yes, but coverage varies. Some insurers offer full coverage with endorsements, others restrict or exclude salvage-branded vehicles.

Some insurers will cover salvage-title vehicles with specific terms; others may limit coverage.

Is it possible to get financing for a salvage-title car?

Financing is possible but not guaranteed. Expect higher interest rates, larger down payments, and extra documentation.

Financing a salvage title is possible but often harder and more expensive.

How does a salvage title affect resale value?

Salvage titles typically reduce resale value and can slow sales, even with repairs and warranties.

Resale value is usually lower for salvage titles and selling can take longer.

What should I look for when verifying a salvage title?

Check the VIN history report, review repair receipts, obtain a professional inspection, and confirm branding with the DMV.

Check the title history, inspect repairs, and confirm branding with the DMV.

What does 'rebuilt title' mean and how is it different from salvage?

A rebuilt title means the vehicle passed a rebuilt-inspection after repairs; salvage is the initial branded status. Some states use 'rebuilt' to describe the road status.

A rebuilt title indicates it passed inspection after repairs; salvage is the initial branding.

The Essentials

- Prioritize clean titles when possible

- Verify title branding before purchase

- Assess total ownership costs for salvage titles

- Obtain independent inspections and full documentation

- Understand how branding affects financing and insurance