Difference Between Clean and Rebuilt Title: A Practical Guide

Learn the difference between clean and rebuilt title, how it affects financing, insurance, and resale. This guide covers definitions, verification steps, risks, and practical buying tips for homeowners and buyers navigating title history.

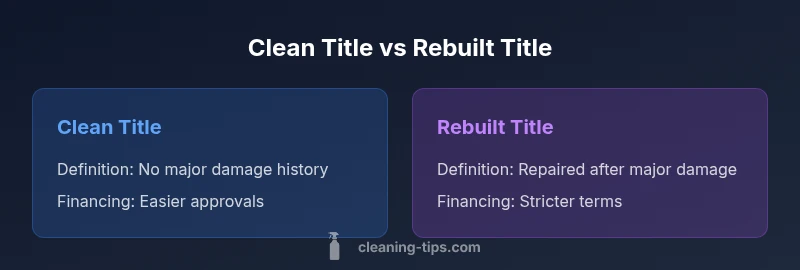

TL;DR: The difference between clean and rebuilt title centers on history and risk. A clean title means the vehicle has no major damage history reported, making financing easier and resale smoother. A rebuilt title means the car was repaired after significant damage and carries higher insurance and resale risk. Choose clean for reliability; rebuilt may save money upfront but comes with trade-offs.

The difference between clean and rebuilt title: foundational concepts

In the world of vehicle ownership, the phrase difference between clean and rebuilt title points to how a car’s history is recorded and interpreted by lenders, insurers, and buyers. A clean title indicates the car has not sustained damage that would trigger a salvage or rebuilt designation. A rebuilt title, sometimes called salvage, signals that the vehicle was damaged, repaired, and reissued with a title that reflects that past. Understanding these terms helps you assess risk, loan eligibility, and long-term costs. The Reading of the phrase difference between clean and rebuilt title is not just about semantics; it impacts financing terms, insurance availability, and resale value. For homeowners and renters who are evaluating used-car purchases, this distinction acts as a first filter that avoids wasteful decisions and unexpected expenses later. The Cleaning Tips team emphasizes that starting with a solid understanding of this difference improves decision confidence and reduces buyer regret.

How title history affects financing and ownership costs

The difference between clean and rebuilt title matters most when you’re negotiating price and terms with a dealer or private seller. Lenders view clean titles as lower risk, which translates to more favorable interest rates and easier approval. A rebuilt title often requires a higher down payment, stricter underwriting, and in some cases, specialized lenders who deal with higher-risk profiles. Insurance considerations follow a similar pattern: clean titles typically receive standard quotes, while rebuilt titles can trigger higher premiums or coverage limits. From a long-term ownership perspective, the distinction impacts depreciation, resale value, and total cost of ownership. The Cleaning Tips approach is to quantify risk using established checks rather than relying on anecdotes. When you compare the two, you should evaluate not just sticker price but potential financing, insurance, repairs, and future sale scenarios. This nuanced view is central to evaluating the difference between clean and rebuilt title for real-world buyers.

How a title is created and recorded: basics you should know

The process behind a title status can be opaque, but the core idea behind the difference between clean and rebuilt title rests on what happens before the vehicle is licensed. A clean title is issued when the vehicle has not sustained damage that would classify it as a total loss by the insurance company. If damage was severe enough to warrant a salvage title and later repaired, the vehicle may be issued a rebuilt title after inspection. These records live in state databases and are shared with lenders, insurers, and buyers through VIN checks. The distinction remains in the official record even if repairs are flawless. For homeowners and renters, knowing where to look—VIN history reports, prior owner disclosures, and state DMV data—lays the groundwork for a transparent buying experience and avoids later surprises.

Financing implications: lender and loan terms in focus

When you’re evaluating the difference between clean and rebuilt title, financing is a practical pivot point. Clean-title vehicles usually secure loan terms similar to those for non-damaged cars, with standard interest rates and longer payoff horizons available to many buyers. Rebuilt-title vehicles tend to attract higher interest rates, larger down payments, or even limited loan options from certain banks. The higher perceived risk arises from potential hidden damages, structural repair quality, and the fact that resale can be tougher for rebuilt titles. If you are considering a rebuilt-title purchase, work with lenders who specialize in higher-risk profiles, and request a full, independent inspection before committing. Be prepared to ask for a detailed repair history and certified documentation to mitigate perceived risk. The key is to quantify the total financing cost, not just the initial price, within the framework of the difference between clean and rebuilt title.

Insurance considerations: coverage and premium differences

Insurance is a major ongoing cost that is sensitive to the difference between clean and rebuilt title. Clean-title vehicles typically qualify for standard coverage with predictable premiums. In contrast, a rebuilt-title car can trigger extra scrutiny from insurers; some carriers may refuse coverage, offer limited policies, or charge higher premiums to offset perceived risk. In some cases, insurers may require a comprehensive damage history and proof of high-quality repairs before offering full coverage. If you already own a rebuilt-title vehicle or are considering one, shop around with multiple insurance providers, provide full disclosure of repairs, and consider adding a higher deductible to offset premium increases. The outcome depends on the specific vehicle, repair quality, and insurer policy, so obtain written quotes before making a decision in the difference between clean and rebuilt title landscape.

Resale value and buyer perception: market realities

The market reaction to the difference between clean and rebuilt title is driven by buyer psychology and risk tolerance. Clean-title vehicles enjoy broader demand, faster sales cycles, and higher reported values in many marketplaces. Rebuilt-title cars often face stigma, narrower buyer pools, and more intense vetting during negotiations. While some rebuilt-title vehicles price aggressively, the price-to-risk ratio can be unfavorable if you plan to sell within a short window or if the market has a flood of rebuilt-title options. If you are aiming to maximize future resale value, prioritizing a clean title is generally the smarter path. Cleaning Tips emphasizes that buyers should not rely solely on price; instead, compare condition, documentation, and post-purchase costs when evaluating the difference between clean and rebuilt title.

How to verify title history: practical checks you can perform

Verifying the title history is essential in addressing the difference between clean and rebuilt title. Start with a VIN check through reputable history services to confirm reported incidents, accident history, and whether a salvage or rebuilt designation exists. Request disclosures from the seller and compare them to DMV records for any inconsistencies. If the vehicle has a rebuilt title, obtain a detailed repair log from a certified shop, obtain receipts for major components, and consider a third-party inspection focused on frame integrity, airbag deployment, and structural alignment. A robust verification process reduces the risk of hidden problems and gives you a clear view of what you’re buying, which is central to sound decision-making in the difference between clean and rebuilt title space.

Practical steps for evaluating a rebuilt-title vehicle: a buyer’s checklist

When the title reads rebuilt, the buyer faces a different decision path. Create a checklist that covers: 1) Verifiable repair records from a licensed shop, 2) Independent mechanical and structural inspection, 3) Exhaustive test drives across diverse conditions, 4) Certified estimates for required repairs and maintenance, 5) Clear disclosure of all known issues and any pending recalls. Keep a running total of potential future costs, including insurance implications and resale hurdles. The difference between clean and rebuilt title will guide whether the observed price discount justifies the added risk. If the rebuilt-title vehicle passes thorough inspection with credible documentation, you can proceed with confidence; otherwise, walk away.

Common myths about clean and rebuilt titles: separating fact from fiction

There are several common myths around the difference between clean and rebuilt title. Some buyers assume rebuilt titles are always “cheap lemons,” while others believe every rebuilt title is repair-worthy with no risk. In reality, the truth lies in the specifics: the quality of repairs, the extent of damage that prompted the rebuild, and the honesty of disclosures. Another misconception is that title status never changes; while rebuilt status often remains on the record, some jurisdictions allow a corrective process after certain conditions are met. The most reliable approach is to rely on official title records, independent inspections, and comprehensive history checks, rather than rumors or isolated anecdotes. In sum, debunking these myths is essential for a rational assessment of the difference between clean and rebuilt title and what it means for your purchase.

Steps to manage warranty, repairs, and future upkeep after a rebuild

If you decide to proceed with a rebuilt-title vehicle, document every repair with certified shop records, warranties, and part numbers. Confirm what remains under any existing manufacturer or extended warranty, and understand how a rebuilt title affects eligibility for service plans. Schedule proactive maintenance and keep meticulous records to preserve resale value despite the rebuilt status. Transparent disclosures, regular maintenance, and high-quality parts can soften the impact of the rebuilt title in the long run. The management of the difference between clean and rebuilt title hinges on proactive care, honest disclosures, and ongoing diligence.

Comparison

| Feature | Clean title | Rebuilt title |

|---|---|---|

| Definition | No significant damage history reported on the title | Vehicle damaged and repaired after significant damage; issued rebuilt/salvage title |

| Financing likelihood | Easier financing with standard terms | Stricter terms or higher down payments; some lenders avoid |

| Insurance impact | Typically insurable with standard coverage | Some insurers restrict or price higher premiums |

| Resale value | Higher resale value due to trust in history | Lower resale value due to stigma and risk |

| Documentation required | Easier to verify history; standard disclosures | More documentation and disclosures; potential repair quality concerns |

| Market availability | More options in the used market | Fewer options; greater due diligence advised |

Strengths

- Easier financing and selling with a clean title

- Greater buyer pool for clean-title vehicles

- Lower insurance friction in most cases

- Clearer ownership history reduces risk

Weaknesses

- Rebuilt-title vehicles can be cheaper upfront

- Higher long-term ownership risk with rebuilt titles

- Insurance prices or coverage limits may be higher for rebuilt titles

- Potential title defects or hidden damages despite repairs

Clean title generally wins for reliability and resale; rebuilt title may be acceptable for budget buyers with due diligence

If you prioritize financing ease, lower risk, and better resale, pick a clean title. If upfront cost matters and you perform thorough inspections, a rebuilt title can be a reasonable option.

Questions & Answers

What does a clean title indicate?

A clean title shows no major damage history reported to the title. It generally means the vehicle has not sustained damage severe enough to be classified as salvage or rebuilt.

A clean title means no major damage history—easier to finance and insure.

What does rebuilt title mean?

A rebuilt title indicates the vehicle was previously damaged and repaired, then inspected and issued a rebuilt or salvage title. This warns buyers about past issues.

A rebuilt title means the car was damaged and repaired and flagged on the title.

Are rebuilt-title cars cheaper?

Rebuilt-title cars can be cheaper to purchase, but they carry higher risk and may incur higher insurance and limited financing options.

They’re often cheaper upfront but come with higher risks and costs later.

Can you insure a rebuilt-title car?

Most insurers will provide coverage, but some carriers limit coverage, require specialized policies, or charge higher premiums.

Yes, but expect higher premiums or policy limitations from some insurers.

How can I verify the title history?

Check the VIN history report, request disclosures from the seller, and consult your local DMV or title records for past claims.

Get a VIN history report and ask for full disclosures from the seller.

Is it possible to convert a rebuilt title to a clean title?

In most cases you cannot convert a rebuilt title back to a clean title; the history remains. You can improve confidence with thorough repairs and inspections, but the rebuilt status often stays.

Usually not; rebuilt status remains on the record, but you can mitigate with documentation.

The Essentials

- Check the title history before buying

- Prioritize clean titles for financing and resale

- Inspect rebuilt-title vehicles thoroughly

- Ask about insurance requirements early

- Compare total ownership costs, not just price